OneSpan Identity Verification

Acquire more customers, reduce abandonment, and mitigate fraud with digital identity verification services.

Gain access to a wide range of digital identity verification services for your financial agreement processes:

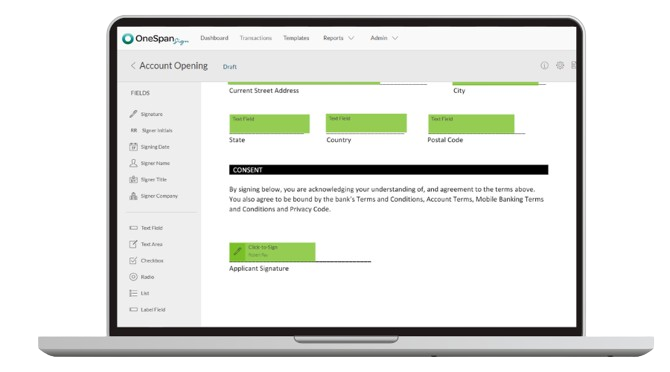

- Acquire More Customers. Enable online channel growth with digital ID verification during account opening .

- Digitize-Account-Opening. Enable remote account opening with digital identity verification paired with e-signatures.

- Access-Multiple-Verification.Select the best verification workflow to optimize for security and UX.

- Leverage AI & Biometric Verification. Verify the authenticity of ID documents in real-time and compare facial biometric data.

- Protect High-value Agreements.Verify identities so that you can get documents electronically signed with confidence.

- Fight Identity Fraud. Detect fraudulent ID documents and prevent application fraud in real time.

Select the best digital identity verification method to balance CX & risk Reduced Friction:

- Reduced Friction. Select the best check types for your demographic to optimize adoption rates.

- Global Coverage. Don’t settle for a single provider with limited coverage.

- Auditable & Enforceable. Capture a single and complete audit trail tied to the entire transaction.

- Single Company. Reap the benefits of a single API integration, SLA, and vendor, and a direct integration with e-signatures.

Onboard more customers with online identity verification

Today’s consumer demands a fully digital experience – available online and on mobile.

The ability to verify a user’s identity online without the need for in-person identity verification speeds up customer acquisition, reduces customer abandonment, and drives growth.

Enable low-friction customer acquisition with digital identity verification.

From a customer onboarding perspective, we are now able to take the customer through a consistent journey. We know that they're getting the information that they need to see and that they're passing through compliance and KYC processes. I think the customer experience is much, much improved to what it was with our paper-based system.